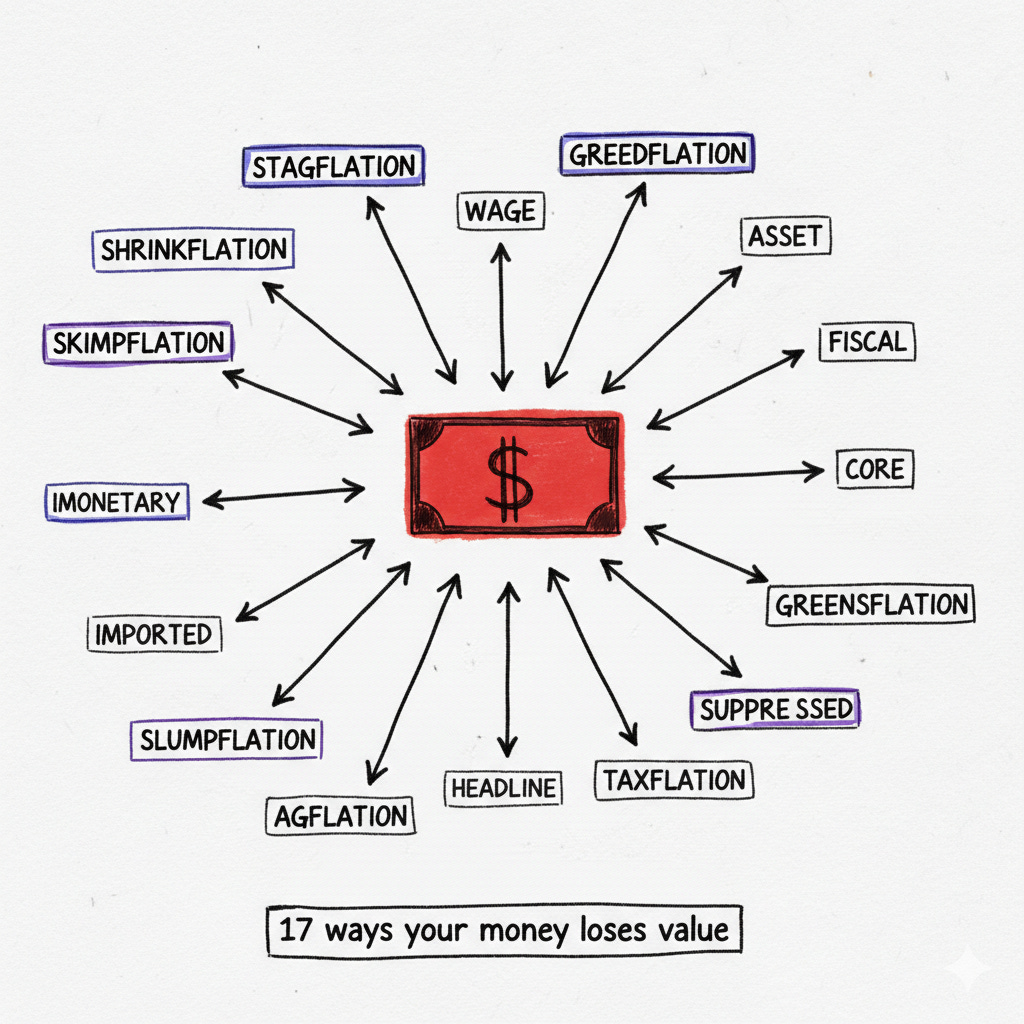

Inflation Isn't One Thing

It's at least seventeen things, and knowing the difference changes everything

There’s a moment in every conversation about inflation where someone says “prices are just going up” and everyone nods, and the conversation ends.

This is a mistake.

Because inflation isn’t one phenomenon. It’s at least seventeen.

And the difference between them isn’t academic—it’s the difference between understanding what’s happening to you and being blindsided by it.

Headline vs. Core Inflation AKA The Visible and the Invisible

Headline inflation is what you see on the news—the total number, the scary percentage, the thing politicians argue about. It includes everything: energy, food, housing, all of it.

Core inflation strips out food and energy because they’re volatile, because they spike and crash, because central bankers need to see the signal through the noise. Since 1983, core PCE inflation in the US has averaged 2.4%. Smooth. Predictable. Boring.

Until it isn’t.

In 2022, when Russia invaded Ukraine, headline inflation exploded while core stayed relatively calm. The difference between them told you everything you needed to know about what was actually happening.

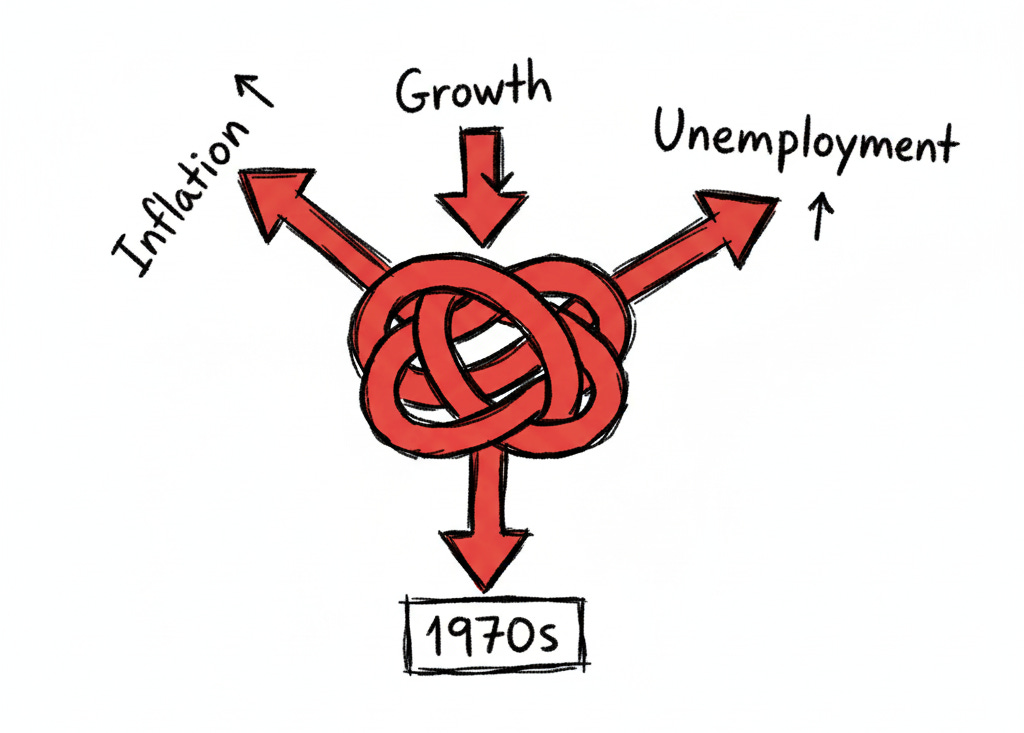

Stagflation AKA The 1970s Invented a Word We Still Fear

High inflation. Stagnant growth. Rising unemployment. All at once.

The thing that wasn’t supposed to be possible.

The oil crisis of the 1970s broke every economic model that mattered. Double-digit inflation. GDP going nowhere. Unemployment climbing. It lasted a decade and changed everything about how we think about central banking.

Paul Volcker had to induce a recession just to kill it. That’s how bad it was.

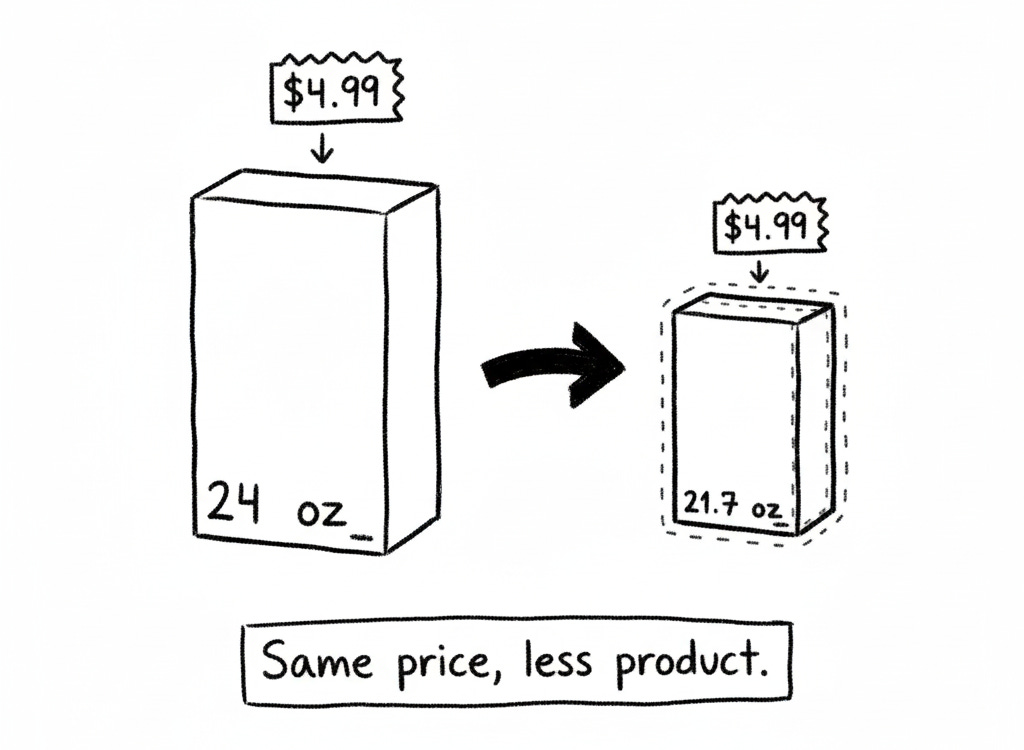

Shrinkflation AKA The Shrinking Box Problem

In the 2010s, Frosted Flakes boxes got smaller. 24 ounces became 21.7 ounces. The price stayed the same.

This is shrinkflation, and it’s elegant in its cruelty because most people don’t notice. You just feel poorer without knowing why. The inflation statistics might say prices are stable, but you’re getting less for your money.

It’s invisible theft spread across a million grocery aisles.

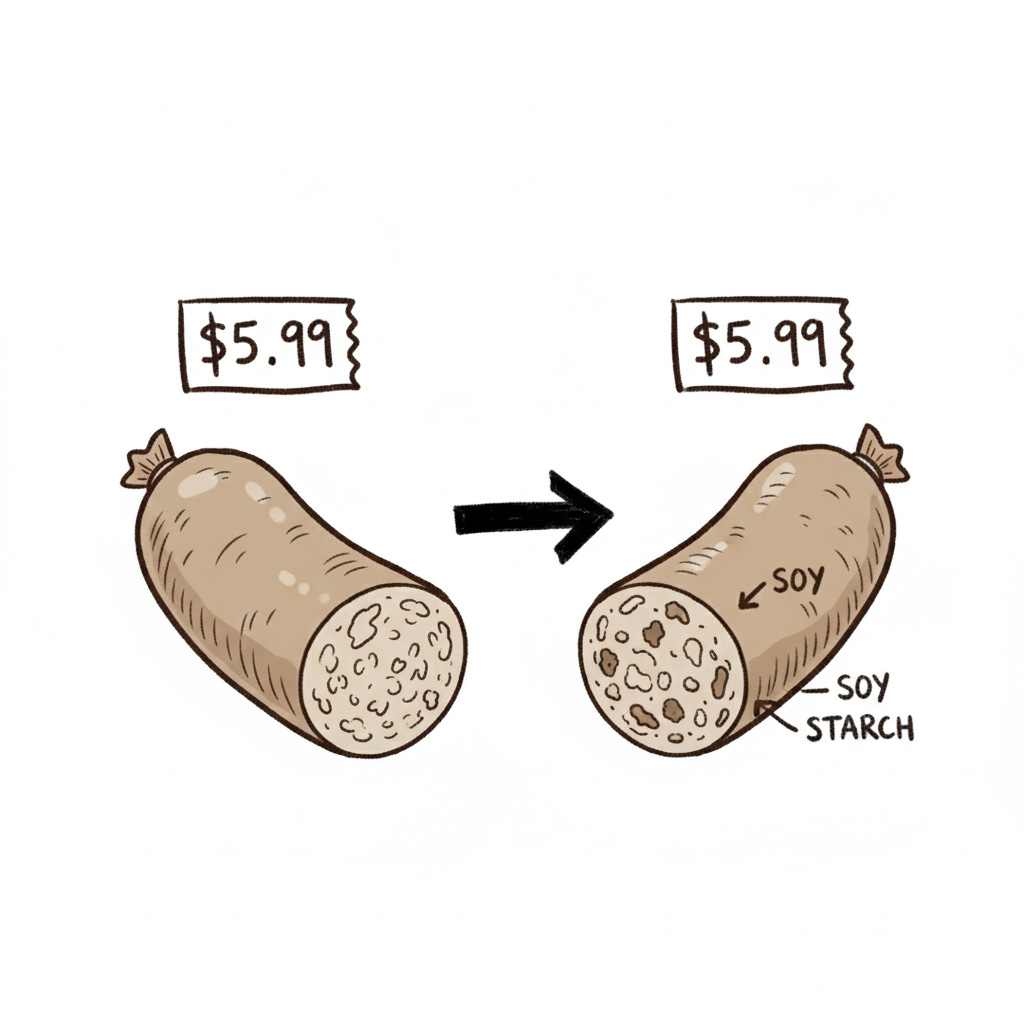

Skimpflation AKA When Quality Quietly Dies

During World War II, the US government imposed price controls to fight inflation. Meatpackers couldn’t raise prices. So they did something worse.

They filled sausages with soy and starch. They downgraded the meat quality. They kept the price the same and the product got worse.

This is skimpflation—the slow degradation of quality while the price tag stays fixed. You’re paying the same but getting less. Not less quantity. Less quality. It’s harder to measure than shrinkflation and easier to deny.

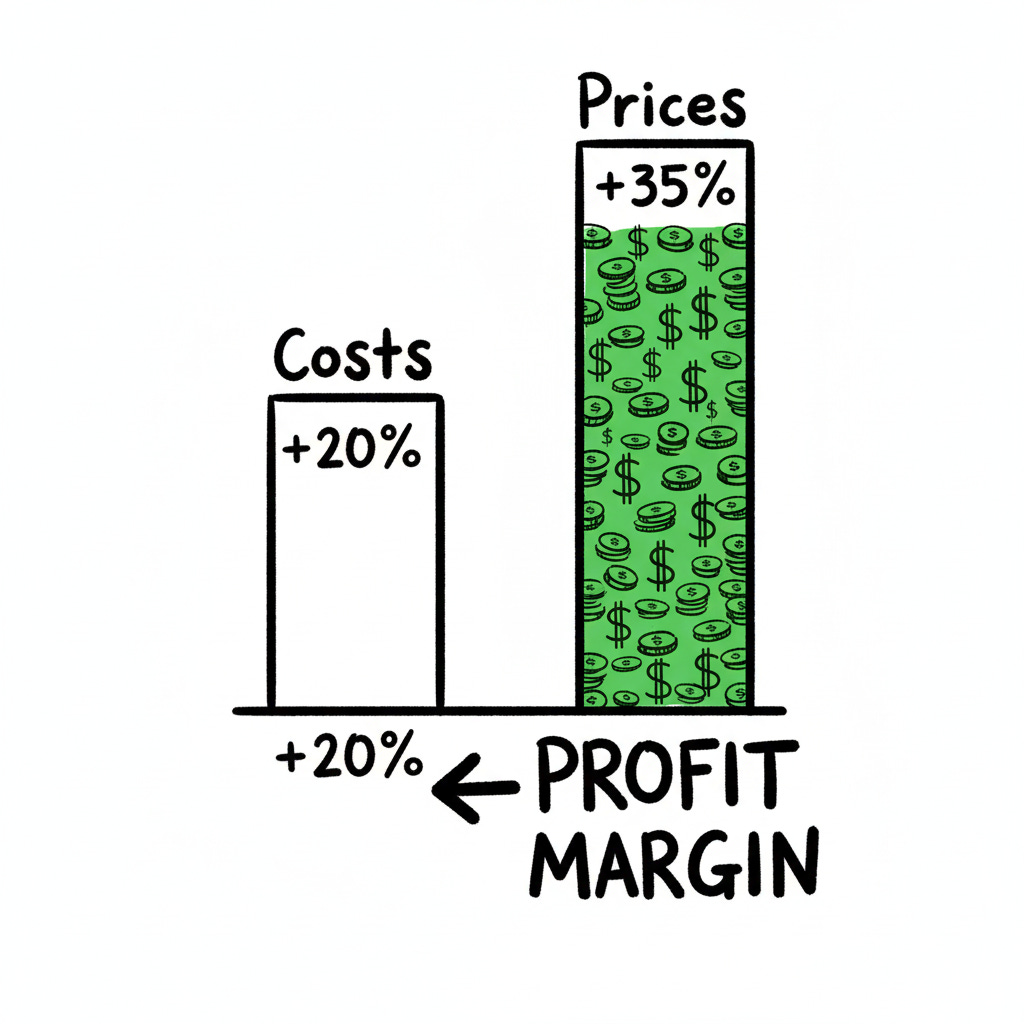

Greedflation AKA The Profit Margin Story Nobody Wants to Tell

In 2023, economists started noticing something strange. Corporate profits accounted for 53% of inflation. More than half.

Not supply chains. Not labor costs. Not energy prices. Profits.

Companies were raising prices faster than their costs were rising. They called it greedflation, and the term immediately became political. But the data was clear: firms were expanding margins, not just passing costs through.

Whether you call it greed or opportunism or market power doesn’t matter. The mechanism is the same.

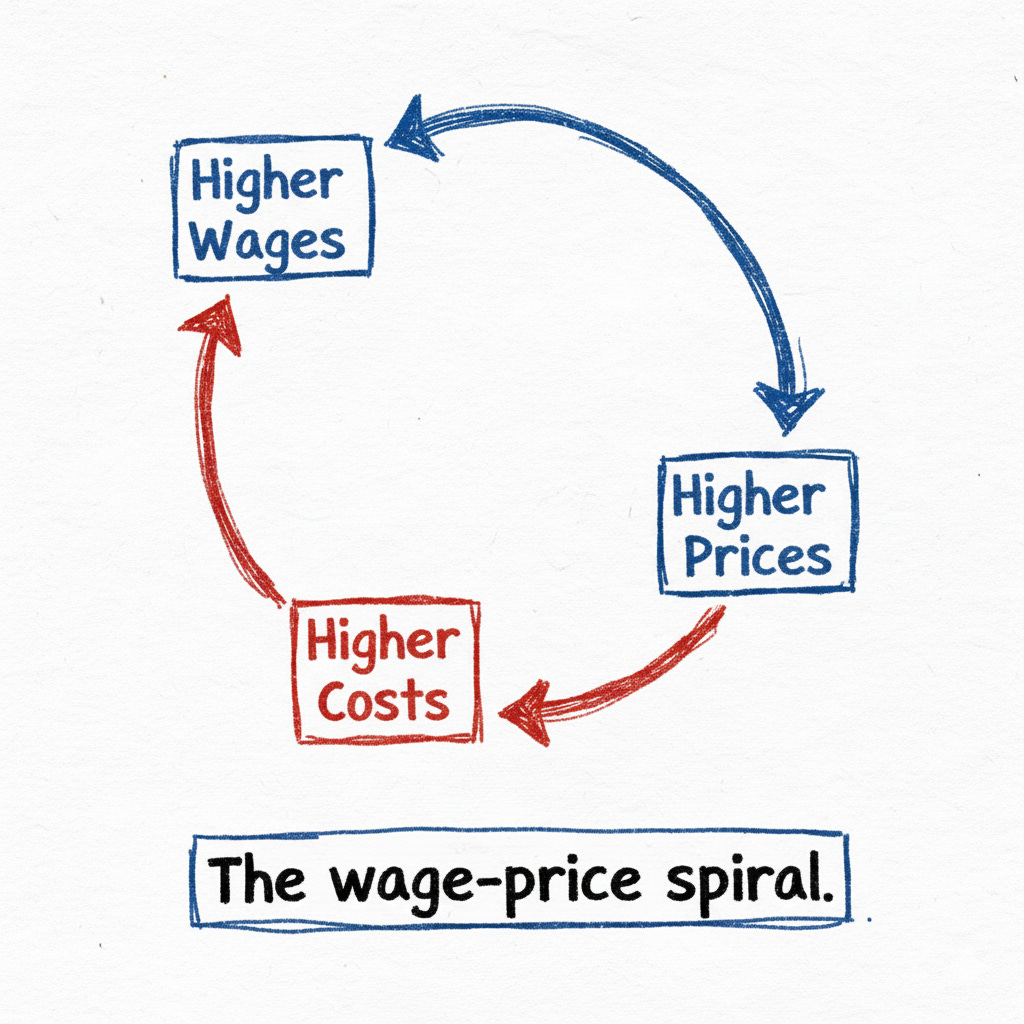

Wage Inflation AKA When Your Paycheck Becomes the Problem

Wage inflation sounds good until you realize what it means. It means wages are rising faster than productivity. Which means labor costs are driving prices up.

In 2021, post-pandemic labor shortages pushed wages higher. Worker shortages. Tight unemployment. Bidding wars for talent. Businesses raised prices to cover the increased labor costs.

The wage-price spiral everyone was afraid of. It wasn’t greed. It wasn’t supply chains. It was just math.

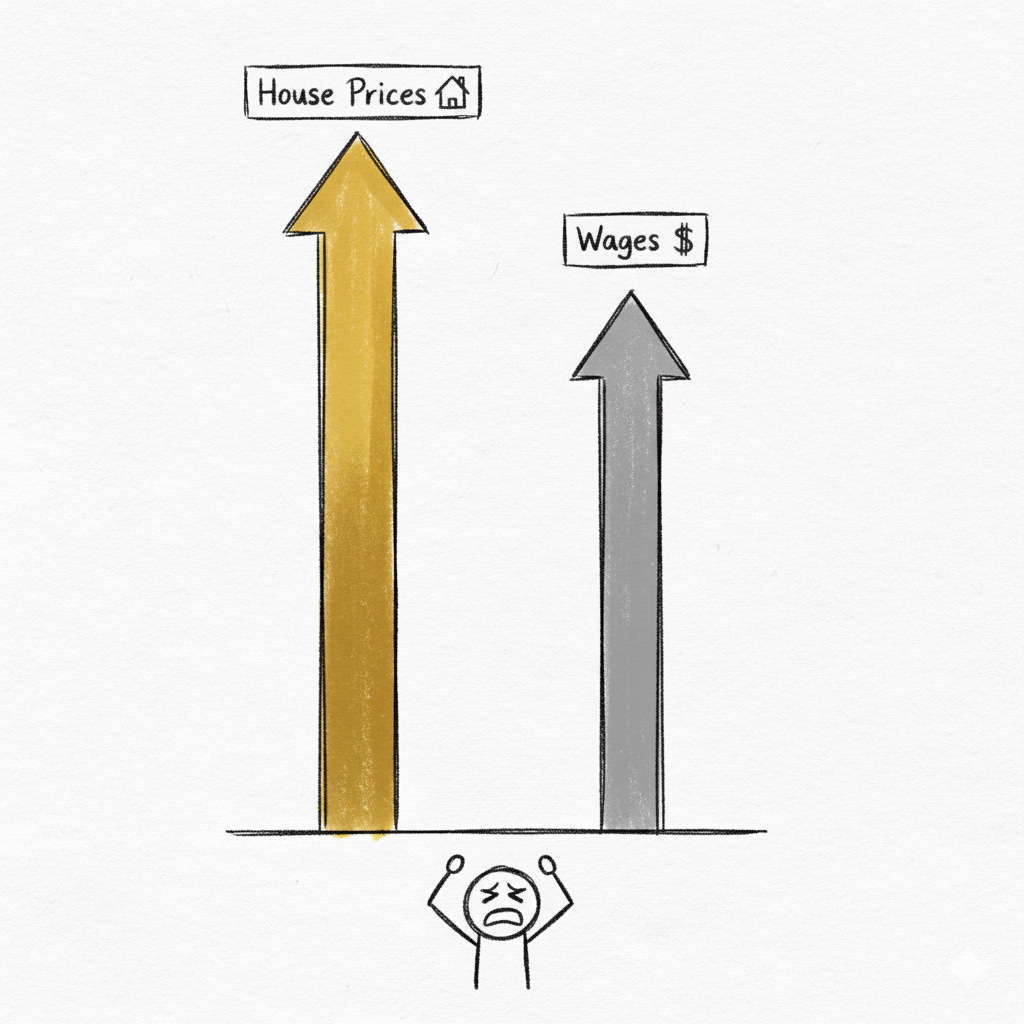

Asset Inflation AKA When Assets Go to the Moon

Between 2002 and 2006, US housing prices exploded. Not because wages were growing. Not because the economy was booming. Just because.

This is asset inflation—when the price of things you buy to get richer (stocks, houses, crypto) rises faster than the price of things you buy to live. It feels like prosperity until you try to buy a house and realize you’ve been priced out of the market entirely.

Asset inflation makes the rich richer and makes everyone else feel poor even when their wages are technically keeping up with headline inflation.

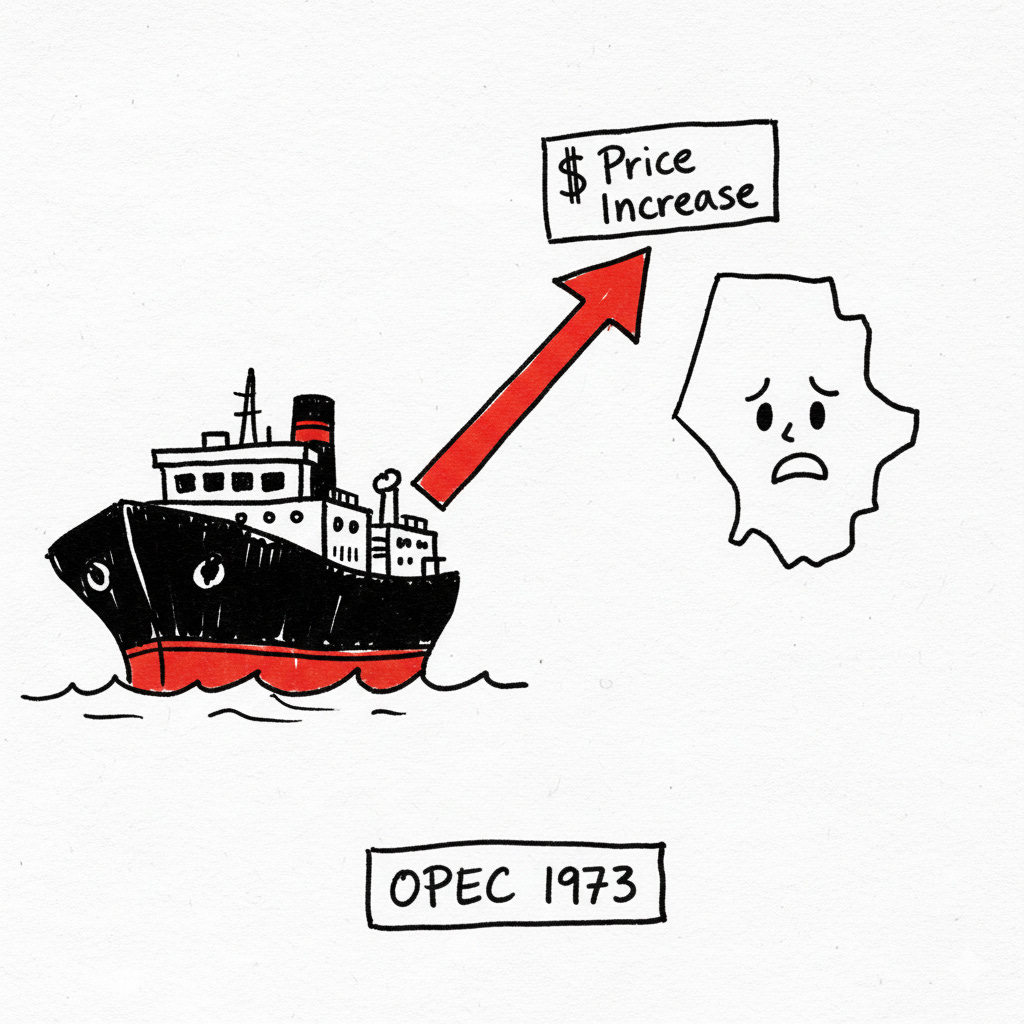

Imported Inflation AKA When Other Countries Export Your Problem

The 1973 oil embargo wasn’t America’s fault. But America paid for it anyway. OPEC cut supply. Oil prices quadrupled. Energy costs soared for every oil-importing nation.

This is imported inflation—when your domestic prices rise because something you import got more expensive. You didn’t print money. You didn’t overheat your economy. You just had the bad luck to need something that got expensive somewhere else.

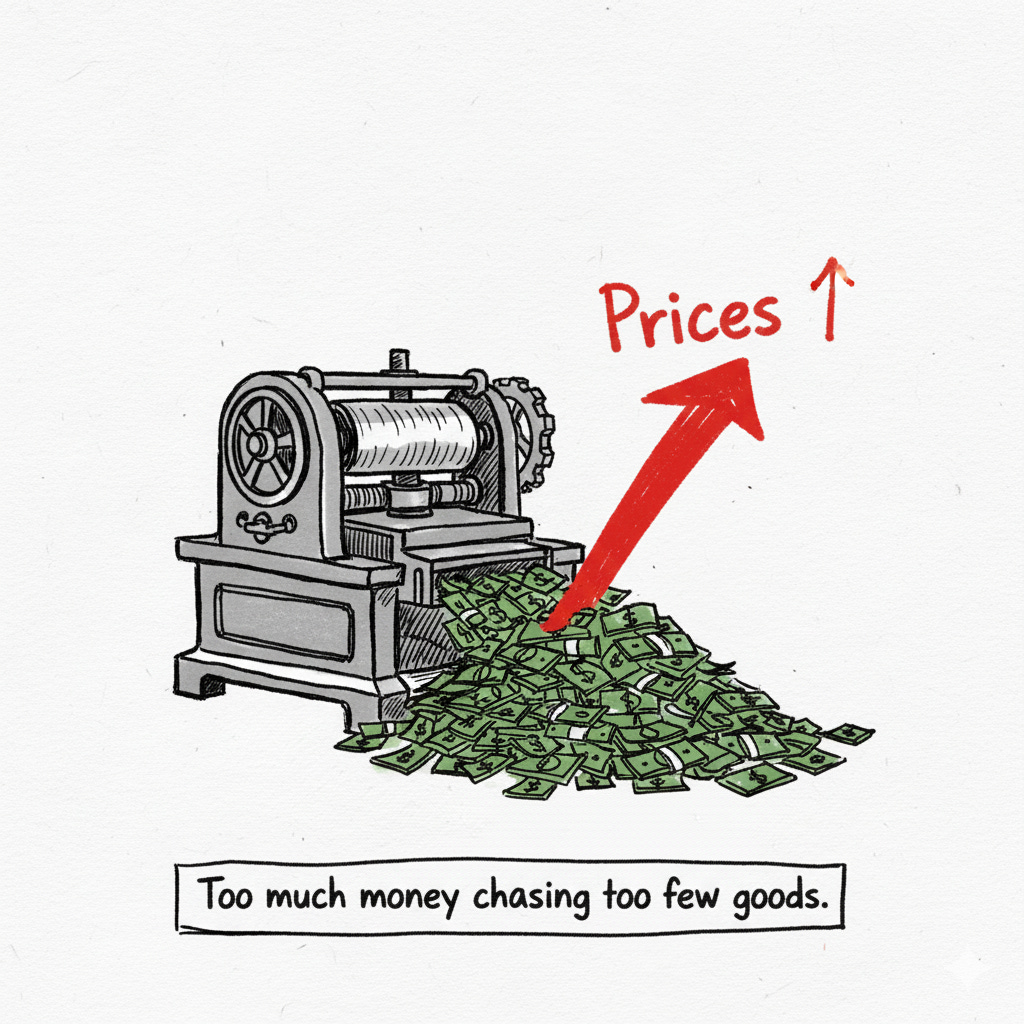

Monetary Inflation AKA The Money Printer Story

The Great Inflation from 1965 to 1982 is the canonical example of monetary inflation. Too much money chasing too few goods. The Federal Reserve ran expansionary policy for years. Inflation topped 14% in 1980.

It took Volcker’s brutal monetary tightening to break it.

This is the inflation story everyone thinks they understand. Print money, get inflation. Simple. Too simple, actually, because it doesn’t explain the other sixteen types. But it’s still true.

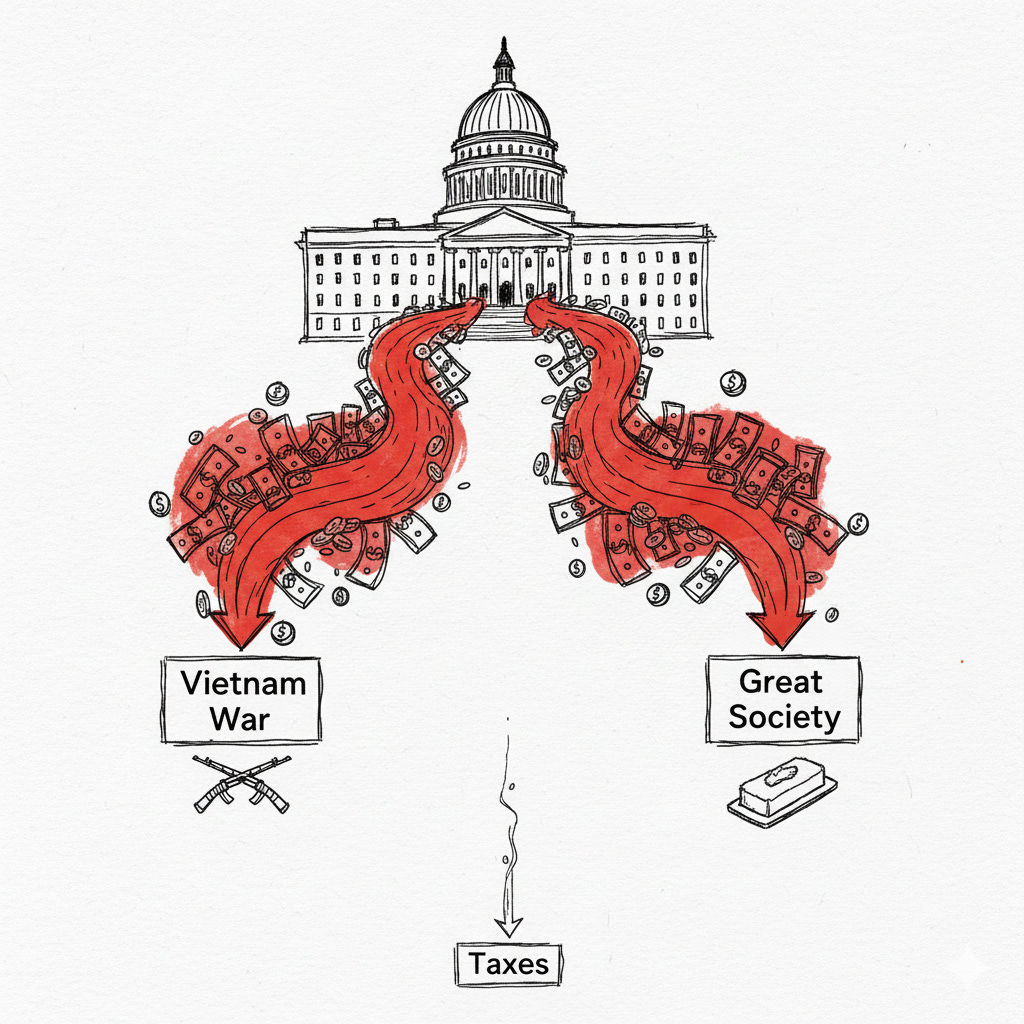

Fiscal Inflation AKA When the Government Spends Too Much

The 1960s and 70s had a phrase: “guns and butter.” Fund the Vietnam War. Fund the Great Society. Don’t raise taxes enough to pay for either.

This is fiscal inflation—when government spending outpaces revenue and the central bank accommodates it. The deficit becomes inflationary pressure. Money flows into the economy faster than goods and services can absorb it.

Politicians love spending. They hate taxing. This is what happens.

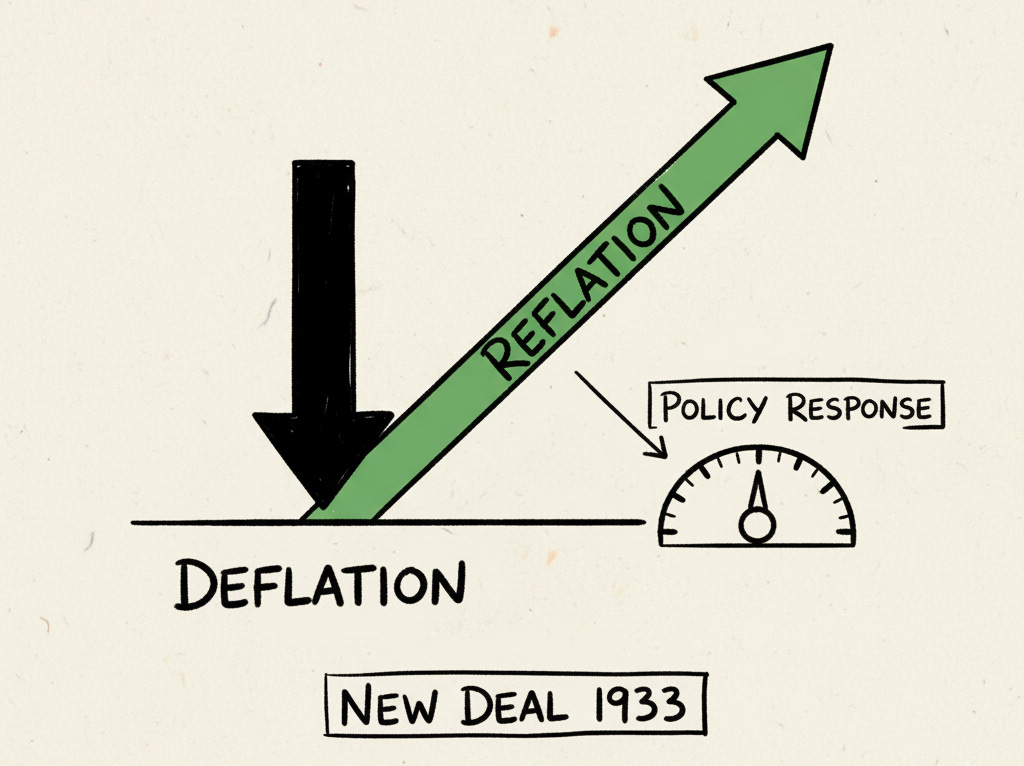

Reflation AKA The Controlled Fire

After the Great Depression, America faced a different problem: deflation. Prices falling. Debt burdens rising. Economic death spiral.

The New Deal was a reflationary policy—deliberately stoking inflation to escape deflation. Between 1933 and 1938, the government spent, the Fed expanded money supply, and prices started rising again.

Controlled inflation. The good kind. The kind that saves you from something worse. Reflation is what you do when the alternative is economic collapse.

Agflation AKA When Food Becomes Unaffordable

In 2007–2008, global food prices surged 50%. Wheat, rice, corn—all spiking at once. Food riots erupted in developing nations.

This is agflation—agricultural inflation. When food prices drive overall inflation, it hits the poorest the hardest. Rich countries complain about grocery bills. Poor countries face starvation.

Agflation is the most politically destabilizing form of inflation because food is non-negotiable.

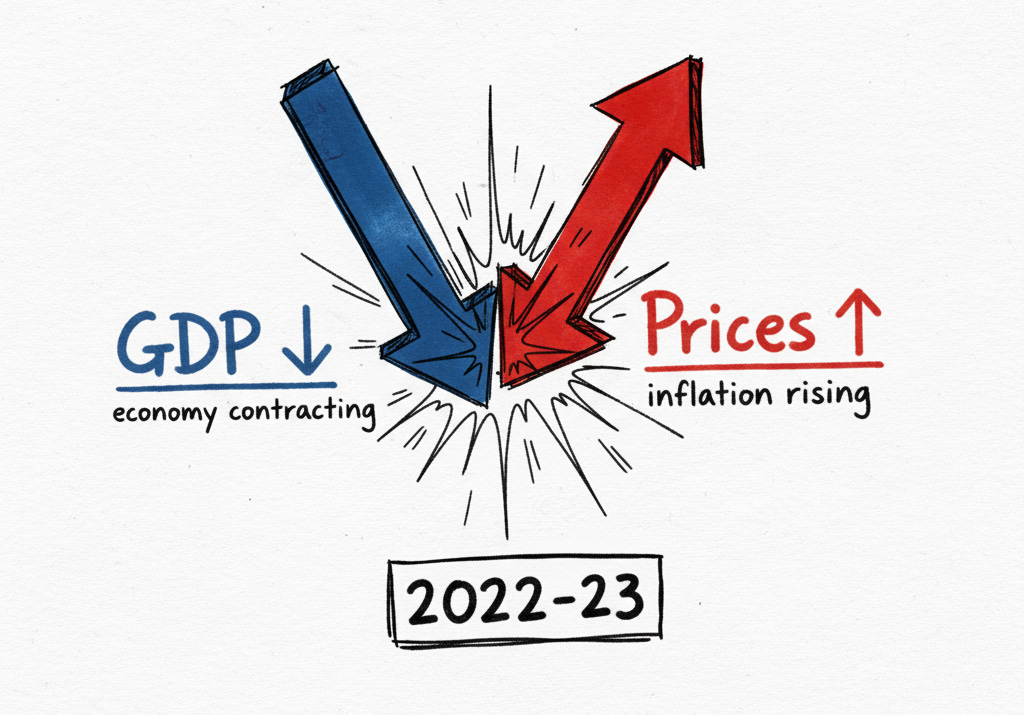

Slumpflation AKA The Recession That Doesn’t Stop Prices Rising

Slumpflation is stagflation’s quieter cousin. Inflation during a recession. Not stagnation—actual contraction.

In 2022–2023, global growth slowed while energy shocks kept prices high. Mild slumpflation. Economies cooling. Prices still rising. The worst of both worlds, just less severe than the 1970s version.

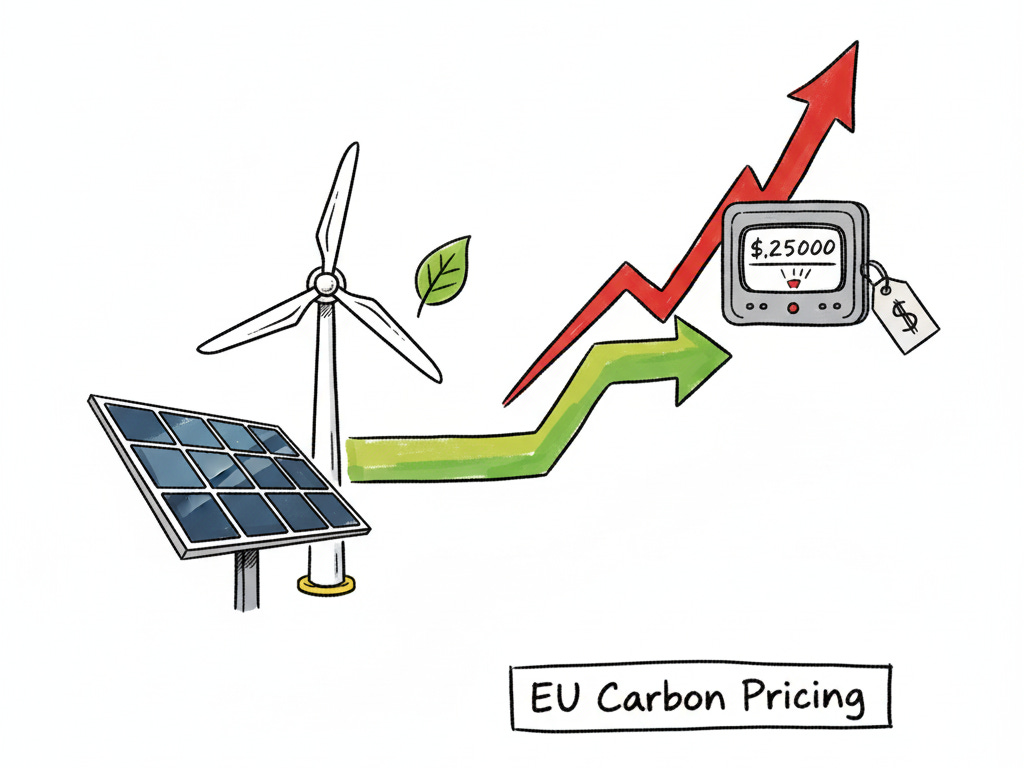

Greensflation AKA The Green Transition Tax

After 2021, the EU implemented aggressive carbon pricing. Energy costs rose across Europe.

This is greensflation—inflation driven by environmental policy. The transition to green energy has a cost. Sometimes that cost shows up in your electricity bill. It’s not greed. It’s not supply shocks. It’s policy.

Whether it’s worth it is a different question. But it’s real.

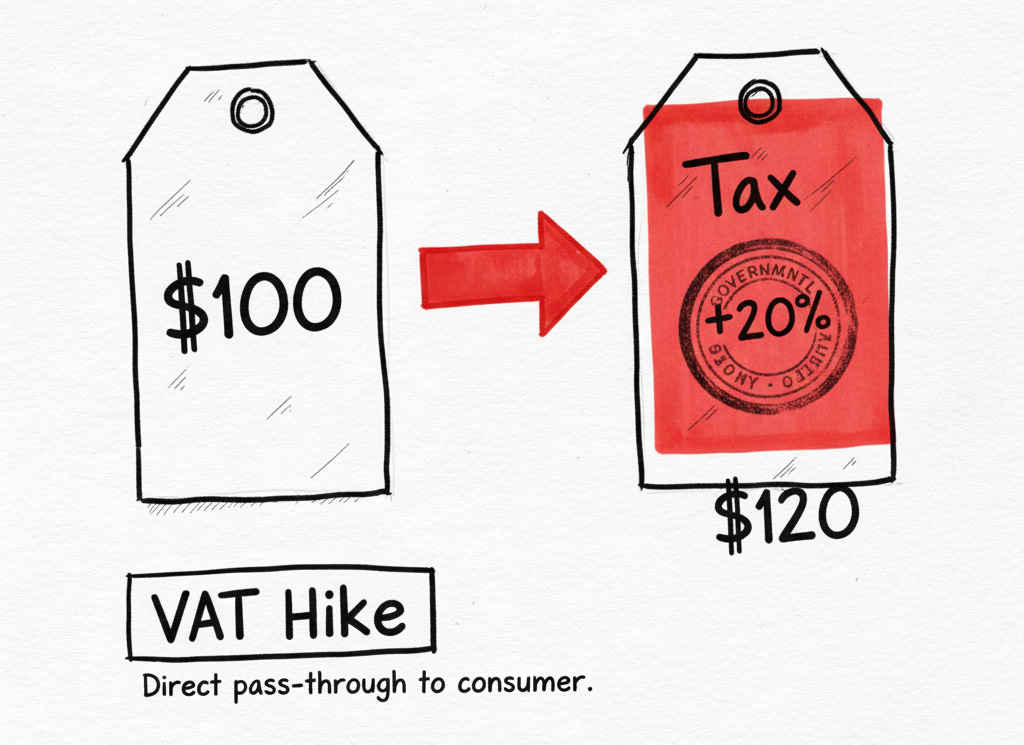

Taxflation AKA The VAT Spike

In 2011, the UK raised its Value Added Tax from 17.5% to 20%. Prices immediately rose. Not because costs increased. Not because demand surged. Because taxes went up.

This is taxflation—when tax increases flow through to consumer prices. It’s usually temporary. It’s always visible. And it’s always politically contentious.

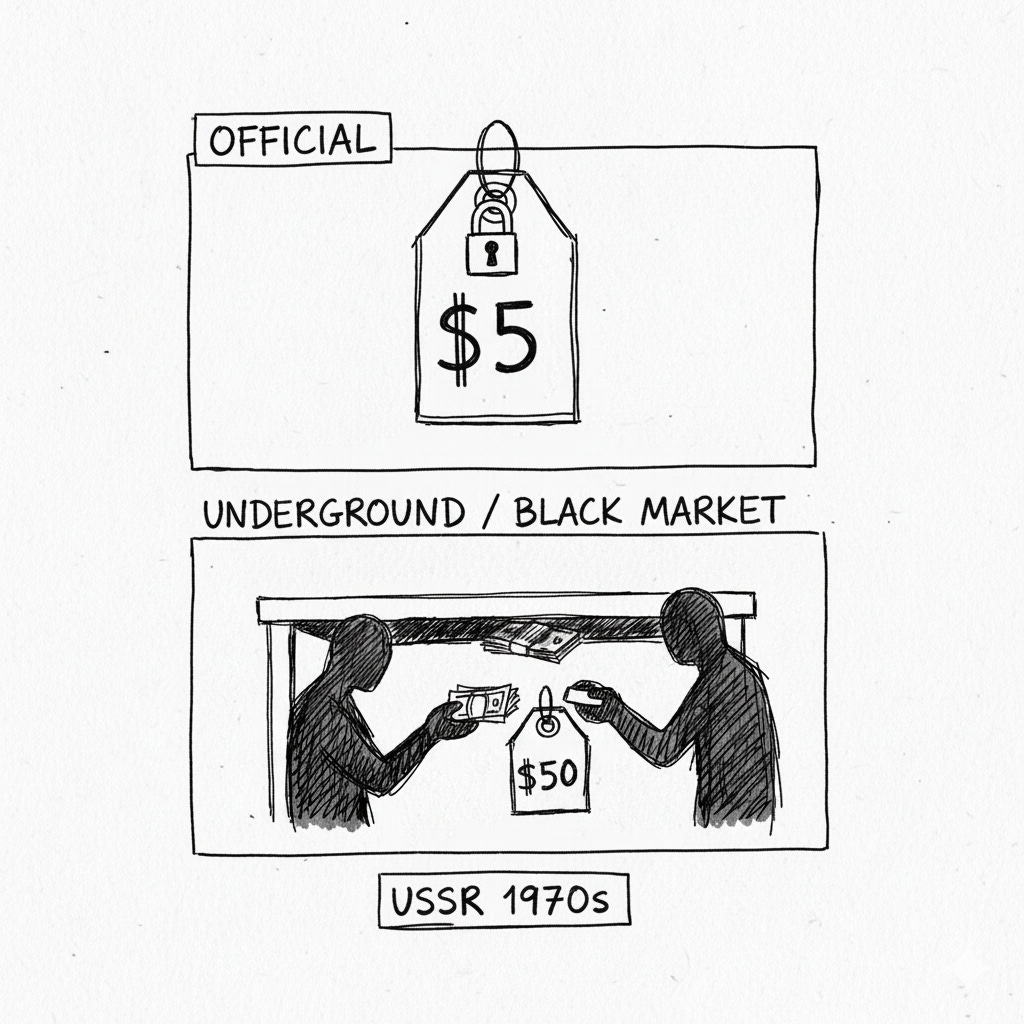

Suppressed Inflation AKA The Inflation You Can’t See

In the Soviet Union during the 1970s and 80s, official prices barely moved. But inflation was everywhere. Empty shelves. Rationing. Black markets charging ten times the official price.

This is suppressed inflation—when government price controls hide the real pressure. The inflation doesn’t disappear. It just goes underground. And when the controls finally break, it explodes all at once.

Why This Matters

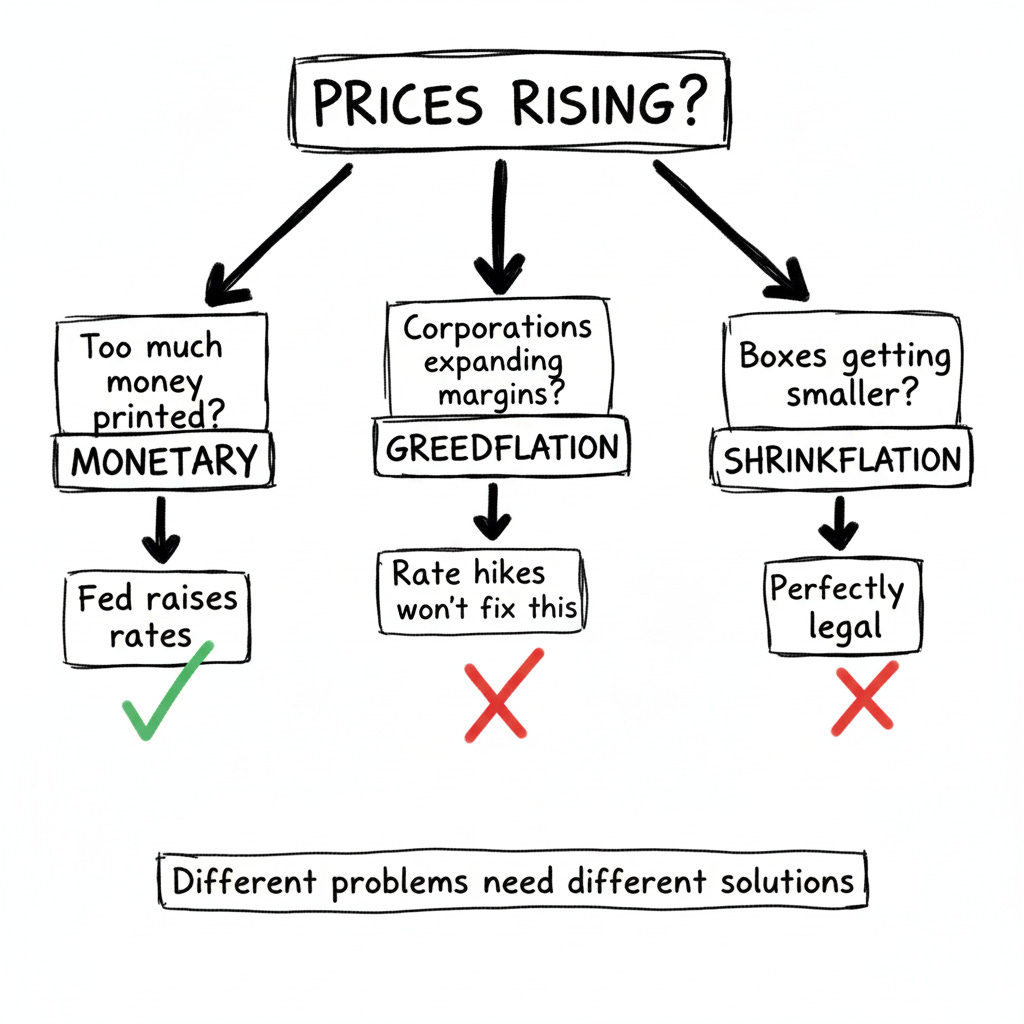

When someone says “inflation is up,” your first question should be: which kind?

Because the answer determines everything.

Monetary inflation? The Fed can fix it. Imported inflation? You’re at the mercy of global markets. Greedflation? You need competition policy, not interest rates. Shrinkflation? Good luck—it’s perfectly legal.

Each type has different causes, different solutions, different winners and losers. The mistake is treating inflation as one thing when it’s seventeen things wearing a trench coat.

The 1970s taught us that inflation can persist despite our best models. The 2020s are teaching us that inflation can come from places we weren’t watching.

And history keeps teaching us that the only thing worse than inflation is not understanding which kind you’re dealing with.

Because when you can’t name the problem, you can’t solve it.

And when you can’t solve it, it solves you.

Wow, the explanation of headline vs. core inflation really stood out to me. How do you see these different types interacting in current EU policy? Such a briliant analysis!

This explains why policy responses feel incoherent. One tool cannot fix seventeen problems.